Full Auth coverage

Support Auth for all US financial institutions

Overview

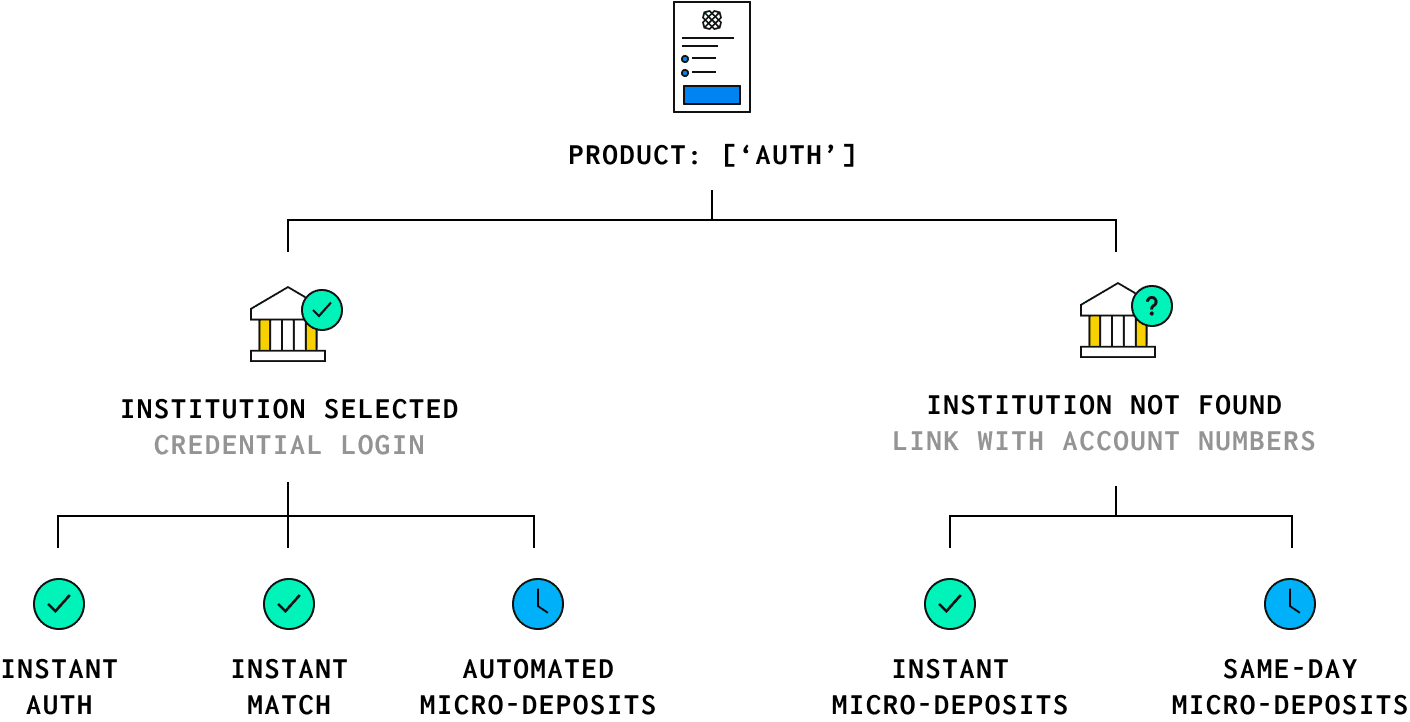

Instant Auth covers approximately 95% of users' eligible bank accounts. For the remaining ~5%, Plaid offers users the ability to connect their accounts through a combination of verifying micro-deposits and account credentials.

To support Auth for all of your users, this guide will show you how to build the following Auth flows:

- Instant Auth: User enters their credentials and is authenticated immediately. This is the default flow. No extra steps are necessary to enable Instant Auth if you have already integrated Auth into your app.

- Instant Match (US only): User enters their credentials, account number, and routing number. Plaid matches user input and authenticates immediately. No extra steps are necessary to enable Instant Match if you have already integrated Auth into your app; it will appear automatically as long as

country_codesis set to['US']. - Automated Micro-deposits (US only): User enters their credentials, account number, and routing number. Plaid makes a micro-deposit and automatically verifies the deposit in as little as one to two business days.

- Instant Micro-deposits (US only): User enters account and routing numbers. Plaid makes a RTP or FedNow micro-deposit and the user manually verifies the code in as little as 5 seconds. Beginning November 1, 2023, no extra steps will be necessary to enable Instant Micro-deposits; it will be automatically enabled as long as

country_codesis set to['US']andauthis the only product in theproductsarray. - Same Day Micro-deposits (US only): User enters account and routing numbers. Plaid makes a Same Day ACH micro-deposit and the user manually verifies the code in as little as one business day.

Plaid will attempt to use the flows in the order of preference listed above. For example, the Automated Micro-deposits flow will only be used if both Instant Match and Instant Auth are unavailable for a given institution.

Accounts verified with account numbers (using Instant Micro-deposits or Same-Day Micro-deposits) do not have active data connections with a financial institution. These accounts and their associated Items can only be used with Auth and Transfer, not with any other Plaid products (such as Balance or Signal), with the partial exception of Identity Match.

For each of these flows, Plaid will automatically prompt the user for the appropriate information. If a user cannot find their financial institution when searching, Plaid Link will prompt them to link with account numbers, where they can enter the Instant Micro-deposits or Same Day Micro-deposits flow.

To see which Auth flows a given institution supports, you can call /institutions/get with options.include_auth_metadata set to true. The results will be returned in the auth_metadata.supported_methods object in the response. Alternatively, you can see this information on the Institution Status page in the Plaid Dashboard.

Each section in this guide is broken down into steps and supporting code samples.

Database Match (coming soon)

For returning users, Database Match can verify account details provided in Link without micro-deposits, reducing friction for accounts that can't be verified via Instant Auth or Instant Match.

Database Match is ideal for use cases where additional products like Balance, Signal, or Transactions aren’t required. Database Match does not confirm the user's access to the account, but confirms the presence of the account as previously authenticated in the Plaid network.

Database Match can be enabled after a user has indicated they want to continue down a manual flow, prior to micro-deposits, or on the embedded search module.

To apply for the Database Match beta, complete the Database Match beta application.

Next steps

Instant Auth, Instant Match, and Instant Micro-deposits

Support the most common Auth flows

View guideAutomated Micro-deposits

Integrate the automated micro-deposit flow

View guideSame Day Micro-deposits

Integrate the manual micro-deposit flow

View guideMicro-deposit events

Learn how to use Bank Transfers webhooks to receive micro-deposit status updates

View guide